Stage 1

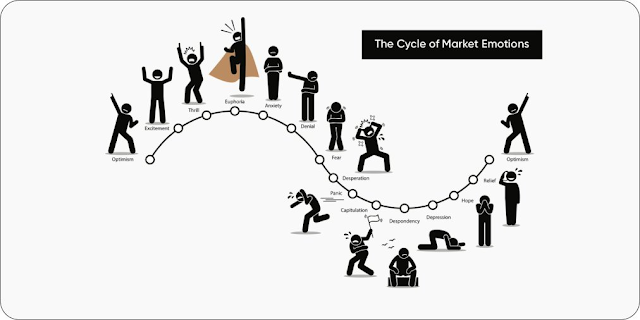

Optimism, Excitement, Thrill, and Euphoria

"Wow, I'm thrilled with this investment."

When you first enter the market, you are enthusiastic about investing and convinced that your risk will be rewarded in the long run. As the market rises, your feelings grow progressively positive, culminating in a state of euphoria when the returns are maximum.

(Stage 2)

The Downturn – Anxiety, Denial, Fear, and Desperation

"A brief setback. "I'm a patient investor."

Uncertainty will make you uneasy when the market begins to fall and your investments lose value. You may watch the market with bated breath until denial takes over and you restore faith in your long-term investment approach. When the market does not improve, you will become increasingly afraid of losing money since you do not know how far the market may fall.

Stage 3:

Panic, Capitulation, Despondency, and Depression

“Perhaps the markets just aren’t for me.”

Continued fall and losses at the bottom of the cycle cause fear. Pessimism and depression make you lose confidence in the market as you wonder how you could have been so incorrect. Ironically, when you are most dissatisfied with your investments, you have the most to gain - the point of highest financial opportunity.

Reminder: Depression and despair may cause you to reconsider your risk appetite and entice you to give up. Avoid selling when your portfolio is worth the least. Consider purchasing while prices are at their lowest.

Stage 4:

The Upswing – Hope, Relief, and Optimism

When the market starts to rebound, you will be optimistic that it will continue to rise. As situations improve, hope and relief may be mixed with cynicism, as you question if the progress will be sustained. As the market improves and returns to a baseline, you will feel more optimistic about your investment chances.

As you ride the stock market's emotional roller coaster, keep in mind the inverse relationship between your emotions and investing possibilities at the top and bottom of the market cycle. While everyone feels the same feelings when they monitor the market, great investors resist the natural emotional impulse to buy high and sell low.

Comments

Post a Comment